Accurate Take Home Pay Estimator

New Zealand PAYE Calculator

Accurate • Reliable • IRD Compliant

Calculate your PAYE tax, KiwiSaver contributions, and student loan deductions instantly. Get your most accurate take home pay estimate for New Zealand salaries.

Our free New Zealand PAYE calculator helps you to estimate your income tax, KiwiSaver deductions, and PAYE obligations based on the latest IRD tax rates. Perfect for employees, contractors, and businesses.

👉 Calculate Now

How PAYE Works in New Zealand

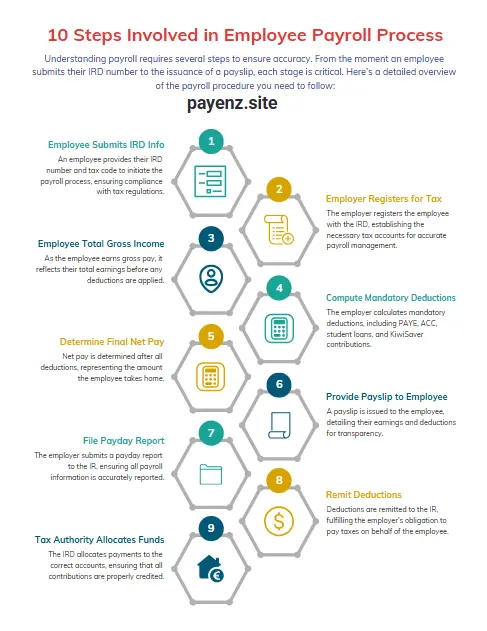

PAYE (Pay As You Earn) is New Zealand’s primary method for collecting income tax, deducting it directly from employee wages at the time of payment

Advertisement

We break down IRD rules into actionable steps, so you stay penalty-free and confident, every payday.

Understanding the basics of PAYE is crucial for anyone involved in employment. You will learn the steps to calculate your PAYE accurately and ensure that deductions are made appropriately. Staying compliant with New Zealand’s tax laws protects you from penalties and helps maintain a good standing with the tax authorities.

Keeping informed about PAYE updates is just as important. Tax laws can change, and being aware of these shifts ensures you stay compliant and avoid unexpected costs. Understanding these aspects can make managing payroll a straightforward task.

- You can easily calculate PAYE to ensure proper deductions.

- Compliance with tax laws is crucial for avoiding penalties.

- Staying updated on PAYE changes keeps your payroll management effective.

Calculating PAYE

Calculating PAYE is essential for ensuring proper tax withholding. This process involves determining your taxable income, applying the correct tax rates, and using available tools for accuracy.

Determining Taxable Income

To NZ PAYE CALCULATOR, start with your taxable income, which is your gross income minus any allowable deductions.

Gross income includes wages, bonuses, and any other earnings. Deductions can include student loan payments, contributions to retirement accounts, and certain expenses related to your job.

Make sure to have all income sources listed. This ensures you do not miss any taxable amounts. Once you have your gross income, subtract the total deductions to find your taxable income.

Applying Tax Rates and Thresholds

New Zealand has a tiered tax system. This means different rates apply to different income brackets.

Here are the current tax rates for individuals:

- Income up to $14,000: 10.5%

- $14,001 to $48,000: 17.5%

- $48,001 to $70,000: 30%

- Over $70,000: 33%

To calculate your tax, apply the appropriate rate to each portion of your income. For example, if your taxable income is $50,000, you would calculate tax as follows:

- First $14,000: $14,000 x 10.5%

- Next $34,000: ($48,000 – $14,000) x 17.5%

- Last $2,000: ($50,000 – $48,000) x 30%

Add these amounts to determine total tax.

Using the PAYE Tables and Calculators

To make calculating PAYE easier, you can use the official PAYE tables or online calculators. The tables provide clear guidance on how much tax to withhold based on income.

These tools simplify calculations by showing tax amounts for various incomes. By entering your gross income, they quickly display the PAYE amount you need to deduct.

Using these resources helps ensure accuracy. This prevents miscalculations that could lead to underpayment or overpayment of taxes. Always double-check your figures to stay compliant.

Compliance and Reporting

To ensure compliance with PAYE in New Zealand, you need to file returns correctly and keep proper records. It’s also important to handle any errors or corrections promptly.

Filing PAYE Returns

You must file your PAYE returns every month. Each return includes your employee’s earnings, deductions, and the total amount you owe to the Inland Revenue Department (IRD).

You can file these returns online through the IRD’s system or use payroll software that meets their requirements. Remember to meet the deadlines to avoid penalties. Here is a simple timeline for filing:

| Deadline | Action |

|---|---|

| 5th of Month | File PAYE return for previous month |

| End of Month | Pay due amount to IRD |

Ensure that you check the IRD for any changes in rules.

Record Keeping Requirements

You must keep detailed records of all PAYE transactions. This includes employee wages, deductions, and your PAYE returns. The records must be kept for at least seven years.

Key documents to maintain include:

- Pay slips for each employee

- Employment agreements

- PAYE returns submitted to the IRD

You can store these records physically or digitally. Just ensure that the information is easily accessible for review when needed.

Dealing With Errors and Corrections

Errors can happen when filing PAYE returns. If you discover a mistake, it’s essential to correct it quickly. You can amend your PAYE return online through the IRD’s portal.

Follow these steps if you need to make a correction:

- Identify the error and note what the correct information should be.

- Log into the IRD portal.

- Follow the prompts to amend the return.

If the correction affects the amount owed, pay any additional tax promptly to avoid interest or penalties. Always keep a record of the changes made for your files.

Staying Updated with PAYE Changes

Staying informed about PAYE changes is crucial for managing your payroll correctly. Regular updates help you comply with regulations and avoid penalties. Here are some ways to keep track of these changes.

Monitoring Changes to Legislation

You should regularly check official websites like the New Zealand Inland Revenue Department (IRD). They provide the latest news on tax laws, rates, and compliance requirements.

Consider subscribing to newsletters or alerts from the IRD. This way, you will receive notifications directly to your email about any legislative changes.

Joining industry groups or forums can also be beneficial. These networks often share insights about new PAYE regulations and can provide support for your business.

Implementing Updates in Your Business

When you receive news about PAYE updates, act quickly. Review your payroll system to make necessary adjustments. Ensure your software is up to date to reflect any new tax rates.

Communicate with your team about these changes. Clear communication is important to ensure everyone understands their responsibilities.

Training may be required to help your staff understand their roles in compliance. Providing resources or workshops on the new regulations can enhance their knowledge.

By keeping your business informed and prepared, you can smoothly adjust to any changes in PAYE.